Defined benefit pensions, the money-for-life gold standard in company retirement programs, are a rarity when you're starting a career. But many companies offer defined contribution pensions or group registered retirement savings plans, which share one key attribute of the DB pension. When the employee invests money in the plan, the employer makes a matching contribution...

Pensions in the News

Most Canadians would choose greater retirement security over more money now: survey

Three-quarters (74 per cent) of Canadians said they'd accept a slightly lower salary in exchange for a better — or any — pension plan, according to a new survey by the Healthcare of Ontario Pension Plan and Abacus Data.

How employers can boost employees' financial security even as pension and insurance benefits shrink

Companies are in a unique position to help their workers without huge costs if they think outside the box.

Retirement planning can be so complex people avoid it altogether. Here's how to avoid that trap

Saving for retirement can be a daunting task. For some people, it is difficult enough to cover their living expenses, let alone put aside money for retirement. For others, the challenges include not only figuring out how much to save, but also, which accounts to contribute to, and which investments to buy. Retirement planning has become more difficult over time, but there are ways it can be simplified.

The pandemic has exposed the precarious economic situation of many Canadian families

So much of the effort to "flatten the curve" of COVID-19 has been to protect some of those most at risk – people with underlying conditions. So it is appropriate that this unprecedented effort – shutting down whole swaths of the economy to combat the virus – has exposed other "underlying conditions" that threaten the long-term social and economic health of our country.

Could coronavirus delay DC plan members' expected retirements?

Defined contribution pension plan sponsors may face workforce planning challenges coming out of the coronavirus pandemic as older plan members whose account balances were hard hit this year's market volatility delay their retirements.

Keep calm and stick to the plan: OPTrust CIO

Although the markets are changing quickly due to the impacts of coronavirus, the OPSEU Pension Trust is a long-term investor and its overall investment strategy hasn't changed, says James Davis, the fund's chief investment officer.

Why we need a better - and simpler - retirement system

We're now deep into RRSP season, that special time of year when many Canadians rush to buy high-priced mutual funds because a financial adviser they meet once a year tells them it is a good idea.

A workplace pension could be worth three times an RRSP — yet only 37% of Canadians have one

Statistics Canada data released earlier this year found that only 37 per cent of Canadian workers are covered a pension plan. Pension coverage continues to decline leaving more workers with a case of pension envy. As pensions become less prevalent in Canada, it begs the question: how valuable is a pension?

Canada ranked among top 10 pension systems in world — but we only got a B

The Netherlands and Denmark have the best pensions systems in the world, according to a global study that shines a light on how nations are preparing aging populations for retirement.

We need to talk about pensions

When I saw the text from my neighbour’s daughter, I instantly feared something had happened at home. There have been various issues in our block of flats recently, including a broken down lift and problematic pipework. Little did I know it would turn out to be a pensions-related emergency.

“When you get home from work, could you print something out for me?” she asked. “Of course!” I replied, expecting it to be an Asos return label (she is 30, and with it).

However, it turned out to be a opt-out form for the workplace pension into which she had just been enrolled. And it wasn’t just any old pension — as she works in the public sector, it was a defined benefit scheme. Blimey.

Tempted to switch on the shredder, I nevertheless felt the most sensible course of action was to put on the kettle.

Almost half of younger Canadian boomers considering delaying retirement: study

More than a fifth (21 per cent) of younger Canadian baby boomers haven't saved for retirement, according to a survey by Franklin Templeton Investments Canada.

Reports highlight social implications of workplace pensions

A report published the Canadian Public Pension Leadership Council in February 2019 offers compelling evidence about the broad benefits of workplace pension plans.

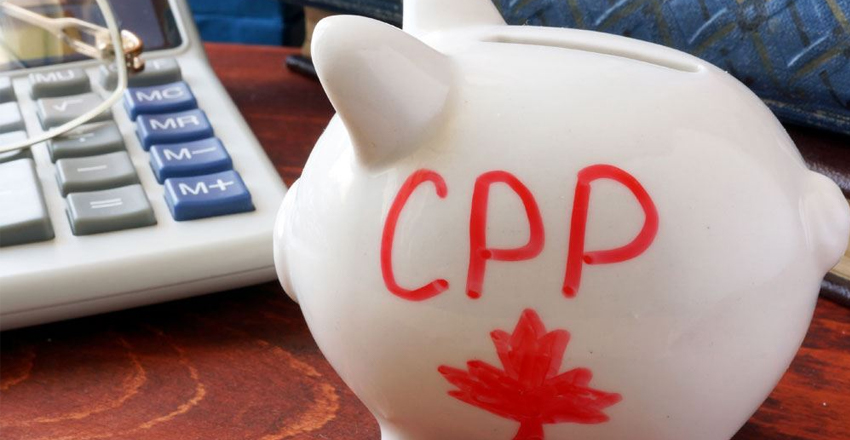

CPP Reform: What’s changing and how will it affect you?

Federal, provincial and territorial finance ministers reached an agreement to expand the Canada Pension Plan, but what will the changes mean to you?

Canada-model pensions are most efficient system

Using a Canada-model pension plan, employees would see $5.32 in retirement income for every dollar they contribute compared to the typical $1.70 resulting from an individual approach, according to a new report the Healthcare of Ontario Pension Plan.

Nonprofit workers offered chance to join Ontario public sector pension plan

The Ontario Nonprofit Network, which advocates on behalf of the province’s 58,000 charities and non-profits, is recommending OPTrust as the sector’s first defined-benefit pension provider.

Generation X is 'stretched beyond their financial limits' and struggling to save for retirement

Given that more than one in four millennials still live with their parents or spouse’s parents, it shouldn’t come as a great shock to learn that almost half haven’t saved for retirement. But members of Generation X (aged 37 to 52) are also struggling to save for retirement and the tighter timeline is causing them stress.

Pension benefits major factor in accepting a job: survey

More than three-quarters (78 per cent) of North American employees and retirees with pension plans said the availability of those benefits was a major factor in deciding whether to accept a job, according to a new survey.

Full CPP benefits are a tough goal to reach

The maximum annual Canada Pension Plan benefit will be $13,610.04 in 2018. Unfortunately only 6% of CPP recipients will reach the maximum.

Spreading the word: OPTrust visits Queen’s Park

OPTrust held a Retirement Security Awareness Day at Queen’s Park, home of the Ontario government, on November 20.

Private pensions form 29% of Canadian families’ net worth: Statistics Canada

According to Statistics Canada, private pensions represent 29% of the net worth of Canadian families, second only to housing.

Two-thirds of Canadian households saving for retirement, census suggests

Research compiled actuary Malcolm Hamilton of the C.D. Howe Institute suggests that the rate of retirement saving for employed people has actually almost doubled in recent decades.

Survivor benefits: A guide to CPP, OAS, GIS and more

Depending on the paperwork signed when you elected to start receiving a corporate pension, your spouse may be entitled to a good percentage of what the lead pensioner is promised: it can range from 50% to two thirds to 75% and may even be 100%.

Retirement planning quick start guide

Your retirement will be as unique as you are. Travel, sports, hobbies, family and friends… no one will combine their activities the exact same way. Here are six steps to help you achieve your unique retirement vision.

What to expect when applying for CPP

Service Canada considers the full CPP pension to be the one that begins the month after your 65th birthday. Maybe that’s why they never reached out to me the five years prior. And it lays out a table that explains how the pension will rise the longer you wait after age 65.

A remedy for business owners suffering from pension envy

If you’re a business owner, your conception of the ideal stream of retirement income may be the kind of defined-benefit pension plan enjoyed public-sector workers and politicians.

Pension industry challenged to deliver plans with DB features prized Canadians

There’s little doubt that working Canadians want a secure source of retirement income. The challenge for the pension industry is how to deliver the desired retirement income in a sustainable manner.

The next retirement security challenge: modest earners

Neither poor nor middle class, modest earners are often employed in precarious work situations, and usually lack access to a pension.

Retirement planning —after you retire

Financial independence can come at any age. There are some frugal types who achieve this “findependence” in their 30s or 40s, although few of them stop working. Henceforth, they may wish to continue to work – but they will be doing so because they want to, not because they feel they have to, financially speaking. For most of us, that moment will come a few decades later.

Millions of Canadians Impacted Income Volatility: TD

Canadians With Unpredictable Income Flows Are More Likely to Experience Financial Challenges and Stress Today and to Lack Confidence in Their Financial Future

Making Workplace Pension Plans More Sustainable

Ontario is moving forward with changes that will help ensure workers' retirement benefits are protected and maintained, while enabling business to grow and be more competitive.

90% of Canadians would pay more for predictable retirement income: survey

Ninety per cent of Canadians would be willing to contribute more to a pension to ensure they have a predictable income at retirement, according to research the Canadian Public Pension Leadership Council.

Retirement Lump Sums Being Depleted Quickly

More than one out of five workers who accepted a lump sum from their employer-sponsored retirement plan have depleted it, a survey found.

Gordon Pape: If you have a defined benefit pension, consider yourself doubly fortunate

If your employer offers a pension plan, consider yourself to be very lucky. According to the most recent information from Statistics Canada, only 38.1 per cent of all workers have access to a pension plan.

Why people hate the thought of deferring their CPP pension

I get it. Canadians really do not like the idea of waiting until 70 to start collecting on their Canada Pension Plan. In my last article, I showed that a couple, whom I called Carl and Hanna, were better off starting their CPP at 70 rather than 65 (both are 65 and on the verge of retirement).

Market value of Canada’s trusteed pensions continues to grow

The market value of Canadian employer-sponsored pension plans grew 3.9 per cent to a total of $1.7 trillion in the third quarter of 2016, nearly doubling the increase of 1.8 per cent in the second quarter of the year, according to new data from Statistics Canada.

Further changes to Canada Pension Plan will have to wait, Bill Morneau says

Finance Minister Bill Morneau says any more changes to the Canada Pension Plan will have to wait for a regular review of the national pension scheme, including a provision aimed at helping women who stay home to raise children.

Did you know 2017 marks the 60th anniversary of Registered Retirement Savings Plans (RRSPs)?

The federal government introduced the investment plan on March 14, 1957. READ MORE about the history of the beginning of the RRSP program

Pension fund assets make up 75% of responsible investing in Canada: report

More than a third (38 per cent) of assets under management in Canada incorporate a responsible investment strategy, up from 31 per cent two years ago, according to new research the Responsible Investment Association.